Real estate syndications give investors an opportunity to invest in large real estate deals that are not normally available to them. It doesn’t require real estate experience nor any of your time. It is the best way to leverage your money and other people’s time. These types of deals yield monthly cash flow and build equity in the deal. This also allows investors to receive a profit upon the sale of the property.

At Bernhardt Capital, we focus on investing in multifamily assets.

What is it?

A Syndication is a structure in which a sponsor and multiple investors pool their money together to purchase Real Estate or to pursue some other type of business venture.

How Does it Work?

There are two main roles in a syndication structure, the syndicator and the investors. Here is each one broke down:

Syndicator

The syndicator, also known as the sponsor, is the expert in a syndication. They will be in charge of:

- Finding the deal

- Securing financing

- Executing the business plan

- Managing the property

- Ensuring all legal documents are executed properly

- Taxes pertaining to the deal

- Distributing profits

- Selling of the property

Investors

Investors, also known as limited partners, provide most or all of the capital required to acquire the asset. They are not in charge of any of the day to day operations.

This is what makes syndications an excellent vehicle to invest in real estate. Many people know of the advantages of owning real estate but don’t have the time to do any of the necessary activities to get a deal done properly.

Sample Returns

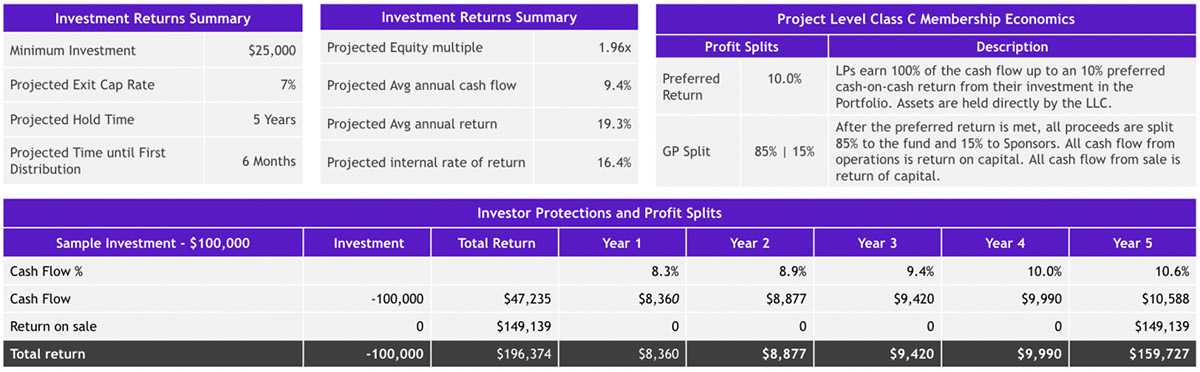

The image above represents the sample returns of an actual deal.

There is a preferred return of 10% and then a waterfall split of 85%/15%

In this example all cash flow from the property up to 10% is given to the investors. Any cash flow remaining will be split 85/15. Investors get 85%, and the syndicator gets 15%.

The example above is done with a $100,000 investment. As you can see, year 1 through 4 has cash flow distributions and then in year 5 there is cash flow distributions PLUS profit upon the sale PLUS your original investment back.

Broken down:

Investment $100,000

Cash flow (Yr 1 – 5) = $47,235

Profit on sale (Yr 5) = $49,139

Original investment back = $100,000

Total return = $196,374

How To Invest?

The first step in finding a deal to invest in is connecting with a syndicator like us.

Ask them to add you to their investor list.

When a deal comes up, they will send out details regarding the investment.

If it fits what you are looking for there will be a button somewhere along the email allowing you to sign up for that investment opportunity.

Investment Timelines

There are a lot of things happening behind the scenes that you may not be aware of. By the time you got notification of the investment the syndicator had already underwritten hundreds of properties until they found the one deal that made sense.

Then:

An LLC was created for this project.

↓

Financing was found and secured for this deal.

↓

Registered the deal with the SEC if required.

↓

– Then you are notified of the investment opportunity –

↓

You decide is a good fit for you and sign up for it.

↓

Shortly after you sign up for it you will receive a series of documents called the PPM (Private Placement Memorandum). You or your attorney should review them.

↓

After you sign the PPM you will receive wiring instructions to fund your investment.

↓

A few weeks later an announcement will be made when the property has successfully closed.

↓

Cash flow distributions will begin 3-6 months after the property closes.

Benefits of Investing in Multifamily Syndication

- Diversification. If you think diversification is a good thing then this may work well for you. When you are actively investing in real estate, it requires you to be flying out to properties, walking properties, talking to contractors, managers, underwriting deals, etc. But if you are investing passive, you have the benefit of investing in real estate across the country and in properties you have never even seen. All the hard work and active pursuit of a deal is done for you so you can easily allocate a percentage of your portfolio towards real estate.

- Leverage. You can use debt to multiply your gains. If you borrow 75% of the property’s cost you have to put down the other 25%. If the total value of the property goes up by 25% then you have just doubled your investment. If you used no leverage and had to purchase 100% of the property’s cost with your own money, then for you to double your money the property will need to double in value which will be very hard to do.

- Inflation-resistant. An inflationary market causes rents to go up. Unlike single family homes, apartment buildings are valued based on income. If the rents go up, income goes up, therefore the value of the property goes up.

- Less correlated to the public markets. When the stock market is having its volatile ups and downs, real estate does not usually follow along with it.

- Hard tangible asset. Real estate is REAL. Meaning there is a building you can see, touch, feel. Unlike stocks whose value can go to zero, real estate will not. There will always be value even in the land where the building sits. Also buildings are insured!

- Appreciation. Real estate naturally tends to appreciate. But aside from that there is a term we call “forced appreciation” meaning we don’t have to wait for the market to naturally appreciate, we can make improvements to the property and increase the overall income. Like we talked about before, a building is valued based on its income, therefore we can force its value to go up!

- Depreciation. Because most of the items and materials used in a building have a limited lifespan we are able to utilize a strategy called a “cost segregation study” which accounts for all the items that can be depreciated over the next several years and take that depreciation against the income from the building in year one!

- Cash flow. The holy grail. Owning real estate can give you cash flow every month or every quarter. I suggest investing in real estate that cash flows from day one. I believe it is a safe way to get through a market downturn should things go bad.

- No time requirement. You don’t have to be involved in the day to day operations! It is the magic of collaboration and teaming up. We can all go further together. You don’t have to be involved in the day to day operations! It is the magic of collaboration and teaming up. We can all go further together.

Cons of Investing in a Multifamily Syndication

- Subject to a bad sponsor. A property needs to be looked after. You can’t just leave it alone and expect it to perform and carry out the business plan.

- Lack of liquidity. Unlike stocks, you can’t click a button and sell a big piece of Real Estate at the same moment. To be able to liquidate real estate is a process that takes 2-3 months from start to finish. Most syndications you can expect to be in for 2-5 years.

- Lack of control. You don’t really have any input on how things should be done. As a passive investor your only role is to invest your money and enjoy the benefits. This is why your due diligence on a sponsor and a deal is very important.

How to Evaluate an Investment Opportunity

I have created an eBook which goes into detail on how to analyze numbers for a property. Visit www.BernhardtCapital.net/ebook and grab it for free.

As an investor your due diligence is mostly on the syndicator. I suggest asking the syndicator for some references of other investors who have invested with them. Call them and ask them about their experience.

Also, ask the syndicator to send you a list of the properties he has gone full cycle on and show you the projected vs actual returns.

I like to see that the syndicator is investing in the deal. This is a little bit controversial sometimes. Some people claim that syndicators need to stay liquid in case of an emergency, so investing in the deal would not allow them to do so. I prefer that the syndicator can do both, invest in the deal and have some cash reserves.

Ask the syndicator about previous deals that have gone wrong and what he did to fix it. This will give you an insight into his problem solving capabilities and if he is someone who you should trust your money with.

Common Fee Structure

Preferred returns

It is typical to see preferred returns of 6% to 8%. Keep in mind that preferred return is not guaranteed cash flow each year. It can occur that cash flow is not enough in one year to pay the preferred return in which case it will accrue and be paid out as soon as more cash flow is available for distributions.

Equity Splits

An equity split is how the distributions will occur above the preferred return. Typically 70/30 or 80/20 is common. Heavily weighted to the investor side.

Syndicator fees

Acquisition Fee: 1 – 3% This is based on the purchase price and paid at closing.

Asset Management Fee: 1 – 2.5% This is to oversee the business plan that is being executed.

Construction Management Fee: 4 – 10% of renovation budget. Paid as renovation funds are spent.

Loan Guarantor Fee: 1 – 5% of the loan amount. This is only if a person was needed to sign on the loan.

Disposition Fee: 1 – 2% of the sales price.

Note: not all the above fees are required. Every syndicator will have some or all of the fees above.

There you go! If you are ready to invest in a multifamily syndication join our investor club by going to https://v1cap.com/invest/

Satch Bernhardt

CEO | V1 Capital

Pingback: How Pilots Can Double Their Money – Bernhardt Capital

Pingback: The Runway To Financial Freedom – Bernhardt Capital