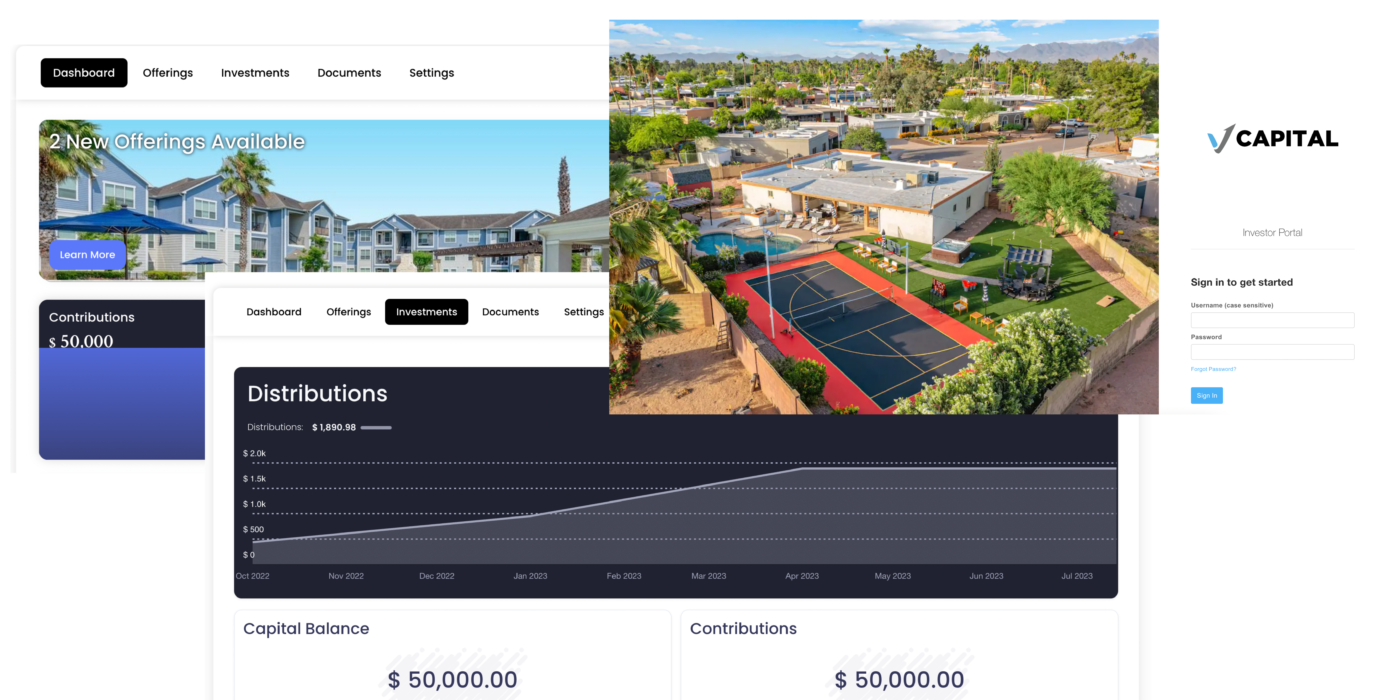

$246MM +

Portfolio Value

1354

Total Units

17 %+

Targeted AAR

6 – 12 %

Target Cash On Cash

WHAT WE DO

Our mission at V1 Capital is to give investors access to institutional quality investments that are typically only available for the Wall Street giants.

By having access to these type of investments investors can accelerate their wealth at a much higher rate than the traditional routes.

We accomplish this by leveraging the power of Real Estate syndications – which is a fancy word for “pooling” money.

Together we can buy these larger assets and tap into the economies of scale that yield greater returns than doing smaller deals alone.

About

Satch Bernhardt | CEO

Satch is a Real Estate investor and airline pilot for a U.S. carrier. He began his Real Estate career by flipping houses in 2018. He grew that company to 31 team members and was then able to step out of the day-to-day operations to begin his Real Estate private equity firm that focuses on Multifamily apartment complexes.

His flying career ended when his airline shut down in the middle of the pandemic in 2020. This was a turning point in his mission with Real Estate. He realized how fragile airline careers are and he wants to help as many pilots as possible get financial security through Real Estate.

He is a Co-GP on $77MM / 350 units and is invested as a Limited Partner in $148MM worth of Real Estate / 726 doors.

Is this you…?

-

Are you seeking Financial Freedom?

-

Do you want to SUPERCHARGE your retirement?

-

Do you max out your 401K every year and have cash in the bank earning a measly 4% or less?

You can become financially free and accelerate your wealth

As pilots we are lucky to have high paying jobs. If done correctly, you can full control of your lifestyle at a young age.

Why wait until you are 65 to start truly enjoying life?

By doing the right math and investing in the right assets you can start complementing your active income with passive income from your investments.

This will allow you to not have to work your full schedule and have the flexibility to drop or swap trips as desired.

We can help you do this!

Why Multifamily?

Multifamily is the least volatile form of investment which does well even in an unstable economy. Investing in multifamily generates a strong monthly cash flow along with multiple tax advantages while ensuring involvement flexibility for our investors.

Stability

Multifamily Real Estate is an attractive asset class that has a long track record of outperforming the major stock indices

Cash Flow

In contrast to other asset types, multifamily Real Estate generates consistent, predictable monthly income

Tax Benefits

Depreciation is a great tax write-off that keeps more of the income in your pocket

Appreciation

Purchasing properties below replacement-cost positions our portfolio well for future appreciation

How It Works

1. Schedule a call with us

Schedule a brief call with us. We will review your goals and form a compliant relationship.

2. Join our list

After our call, we will add you to our investor list and send you opportunities as they become available.

3. Invest

Enjoy the benefits of Multifamily Investing! Our team will be here to support you throughout the entire process.

Portfolio

We currently hold equity as LP or GP in the following properties

Investor Reviews

Aviation goes through many cycles and unfortunately this affects the life of many pilots.

Our mission at “The Cash Flow On The Fly” podcast is that pilots can become educated on real estate investing strategies so that they can become financially free.

If pilots gain control of their financial security, they no longer have to worry about being furloughed, airline shutting down, losing seniority, etc. or maybe they simply would like a more laid back schedule.

The cash flow from your investments can pay for your lifestyle while you do what you enjoy!

SATCH BERNHARDT

I help Investors get on the ‘flight path’ to financial freedom

Grab a FREE copy of my eBook Today!

Why invest in syndications

How to analyze a deal