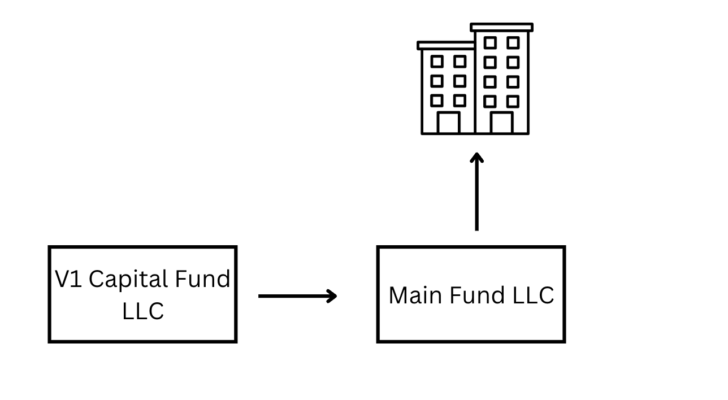

V1 Capital’s primary role in most real estate syndications is to serve as a fund manager providing equity. Having served many different roles in the real estate space throughout the years, I ultimately made the decision that fund management was the space I wanted to focus on while letting our partners run at full force with the other roles needed for every deal. This could change in the future, but as of right now it remains the space in which we want to continue working on.

Some investors wonder if by investing in a fund like ours that is investing in another fund is like getting charged double the fees and therefore making less money overall. Although this is not the case, I can see why they would think that.

Some fund managers may not be as efficient at raising capital and as such their ability to obtain favorable returns for their investors might not be possible.

In our case, we are fortunate to have the experience and ability to bring large sums of capital in each of our funds for every deal. This alleviates a lot of the work needed from our partners in the syndication resulting in our fund achieving higher returns than if any investor were to go straight to the main fund itself.

To put this into perspective,

For our last deal if you invested in the main fund your projected returns were:

Equity Multiple: 2x

Average Annual Return: 20%

IRR: 16%

If you invested in our fund, your projected returns were:

Equity Multiple: 2.17x

Average Annual Return: 23.4%

IRR: 17.9%

How are we able to make this happen for our investors?

Primarily because like I mentioned earlier, we can bring large sums of capital from our extensive investor network that we can negotiate the best terms possible for our fund to the point that our investors make more money than any other Limited Partner in that same deal.

We also keep our fees low.

As you have seen, we only charge a 2% acquisition fee upfront and that’s it.

The majority of our compensation comes from when we sell the property and our investors have made certain return metrics before we can start seeing any promote (compensation).

We don’t charge any assets under management fees like many firms do. I don’t personally like that given that they get to collect a fee regardless of how the deal is performing.

I like to be compensated based on performance.

Hope this gives some clarity to V1 Capital structures deals and how the fund of funds model works!

Satch Bernhardt

CEO | V1 Capital