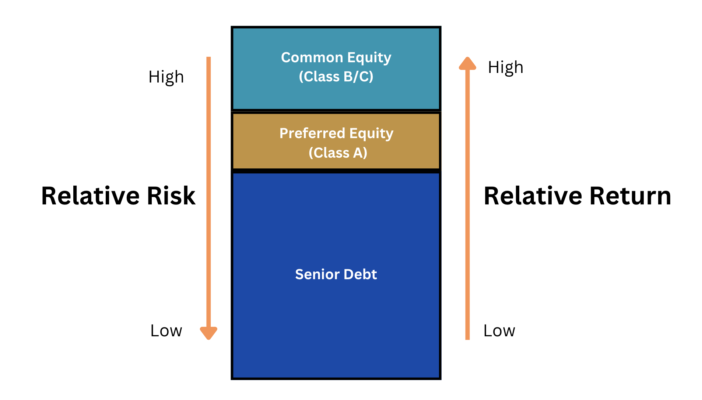

In real estate finance, the capital stack refers to the various types of financing that are used to fund a project, ranked by their priority of repayment if the project fails or faces financial distress. Let’s break down the components of a typical capital stack for a multifamily deal:

- Senior Debt:

- Definition: Senior debt is the primary source of financing in the capital stack and has the highest priority for repayment in case of default or foreclosure.

- Characteristics:

- Usually provided by traditional banks or financial institutions.

- Secured by the property itself, often with a first lien position, meaning it takes precedence over other claims on the property.

- Typically carries the lowest interest rates among the various components of the capital stack due to its priority and security.

- Preferred Equity (Class A):

- Definition: Preferred equity sits between senior debt and common equity in the capital stack hierarchy.

- Characteristics:

- It represents a hybrid form of financing that combines elements of debt and equity.

- Preferred equity investors have a higher claim than common equity holders but are subordinate to senior debt holders in terms of repayment priority.

- They may receive a fixed dividend (similar to interest payments) or a preferred return before common equity holders receive any distributions.

- Common Equity (Class B/C):

- Definition: Common equity is the riskiest form of capital in the capital stack.

- Characteristics:

- Common equity holders are the owners of the property and have the highest potential for returns.

- They bear the highest risk because they are the last to be paid in case of financial distress or liquidation, after all debt obligations and preferred equity returns have been satisfied.

- Common equity investors typically participate in the profits of the project through distributions and potentially through appreciation in the property’s value.

Example Application:

- Suppose a multifamily project requires $10 million in total financing:

- $6 million could be funded through senior debt.

- $1 million could be funded through preferred equity.

- $3 million could be funded through common equity.

In this example:

- Senior debt holders would have the first claim on the project’s cash flows and collateral.

- Preferred equity holders would receive their preferred return before common equity holders.

- Common equity holders would receive distributions or profits after satisfying the obligations to senior debt and preferred equity.

This is also important to understand because different investment opportunities may offer investment options as Class A, B, or C.

Sponsors may label common equity and preferred whatever class they want between A,B, and C. There is no set requirement as to which class belongs to which section of the capital stack, that’s why it is good to know the name of each section in the capital stack.

Using Preferred Equity to fund a portion of the deal can actually boost returns for the common equity holders since the preferred equity holders don’t participate in the equity upside. They only receive a fixed return.

Class B and C within the Common Equity section sit side by side in order of priority. The only difference typically between these 2 is that one of them will offer higher splits between General Partner and Limited Partner. Something like Class B 70/30 split, and Class C 80/20.

Understanding the capital stack is crucial for investors, developers, and lenders to assess risk and potential returns associated with real estate investments. Each layer of the capital stack represents a different level of risk and reward, reflecting the priorities and protections of the various investors involved in the project.

Satch Bernhardt

CEO | V1 Capital